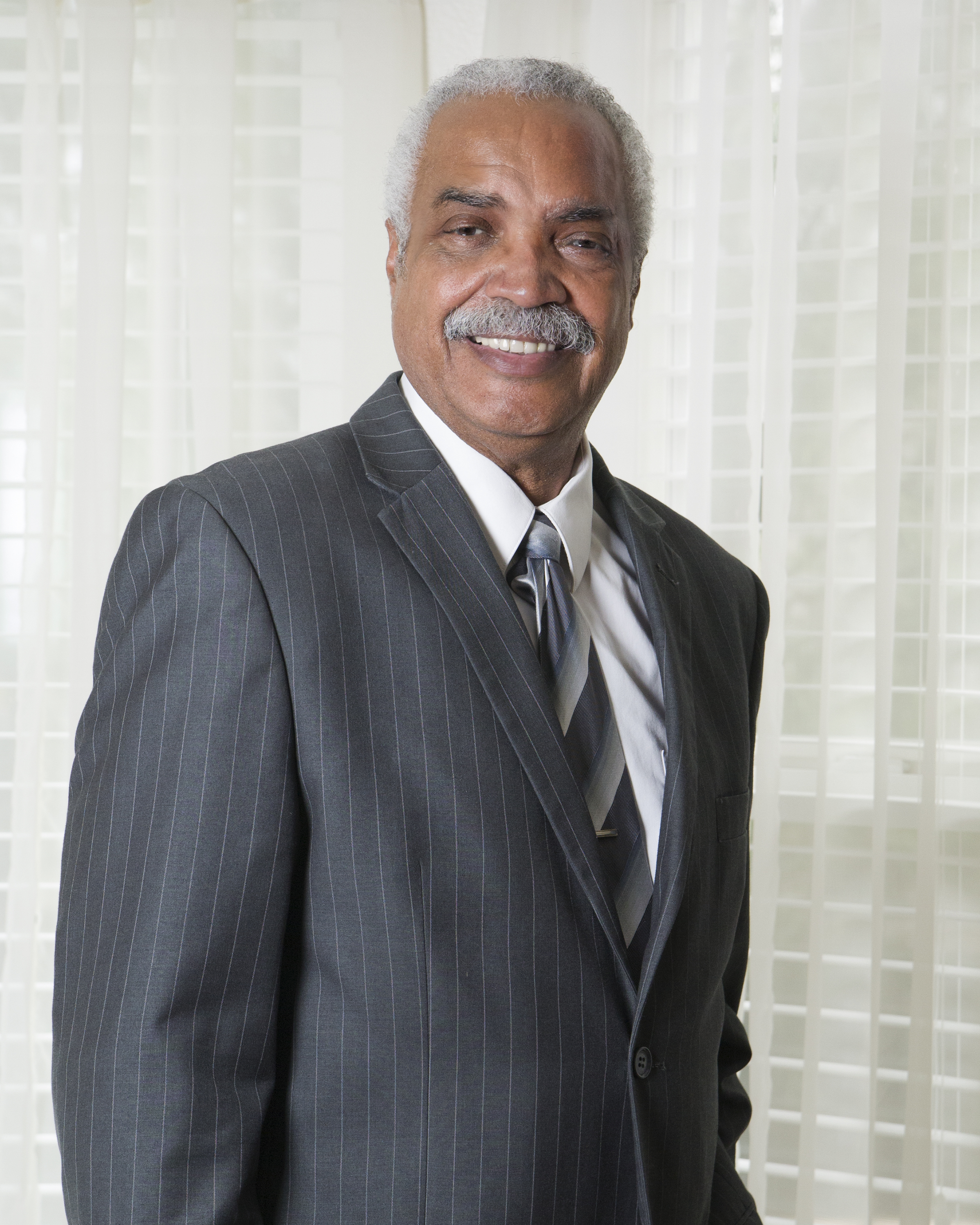

With his customer-focused approach, Retirement

Income Planner Theodore “Ted” Bytnar develops

fresh approaches and new solutions to help clients

overcome change and reach their financial goals.

“It’s all about knowing your client, establishing

goals, and building trust.”

Bytnar uses his 28 years of experience in the financial

industry and his past successes to help clients

evaluate the most effective solutions. “I’ve seen how

clients have utilized the services we’ve rendered,” he

says. “I use this experience to help new clients make

effective decisions.”

When meeting with individual and business clients,

Bytnar gathers information on their insurance and

financial product needs. Rather than offering a one-sizefits-

all product, he evaluates their goals and proposes

customized coverage options to protect their wealth.

“My creative way of approaching specific situations

allows me to help my clients problem solve,” Bytnar

says. “I have clients with unique situations who need

to be at a certain point in a certain time financially,

and it motivates me to help them reach their goals.”

Working with individuals approaching retirement

or already in retirement, Bytnar says his objectives

are to build a strong relationship and continually

communicate and revisit their investments to keep

their plan on track so clients can live the retirement

of their dreams.

Bytnar is licensed in Life and Health insurance,

Property and Casualty insurance, as well as in Real

Estate. He began his career in the financial industry in

1987 as an insurance wholesaler. While overseeing

more than 50 insurance agents, he became an expert

in the wide variety of products offered. He also

championed superior customer care and excellence

for both new and existing clients.

In his free time, Bytnar is an avid golfer and

mountain biker. He enjoys attending sporting events

with friends and family, staying active outdoors and

playing sports.

.jpg)

.jpg)

.jpg)

.jpg)

.png)

.png)

.jpg)